The Pin in Waiting: Evaluating Risk in the AI Boom

The AI boom is real, but soaring valuations have outpaced fundamentals. This piece explores how hype, speculation, and late-cycle behaviour are inflating a bubble that will eventually meet reality - and why disciplined risk management matters now more than ever. Personal views. Not investment advice.

There is a saying in our business, one that separates the speculators from the investors, the gamblers from the owners. It was gifted to us by the Oracle of Omaha, Warren Buffett. It's a simple truth of every boom-and-bust cycle:

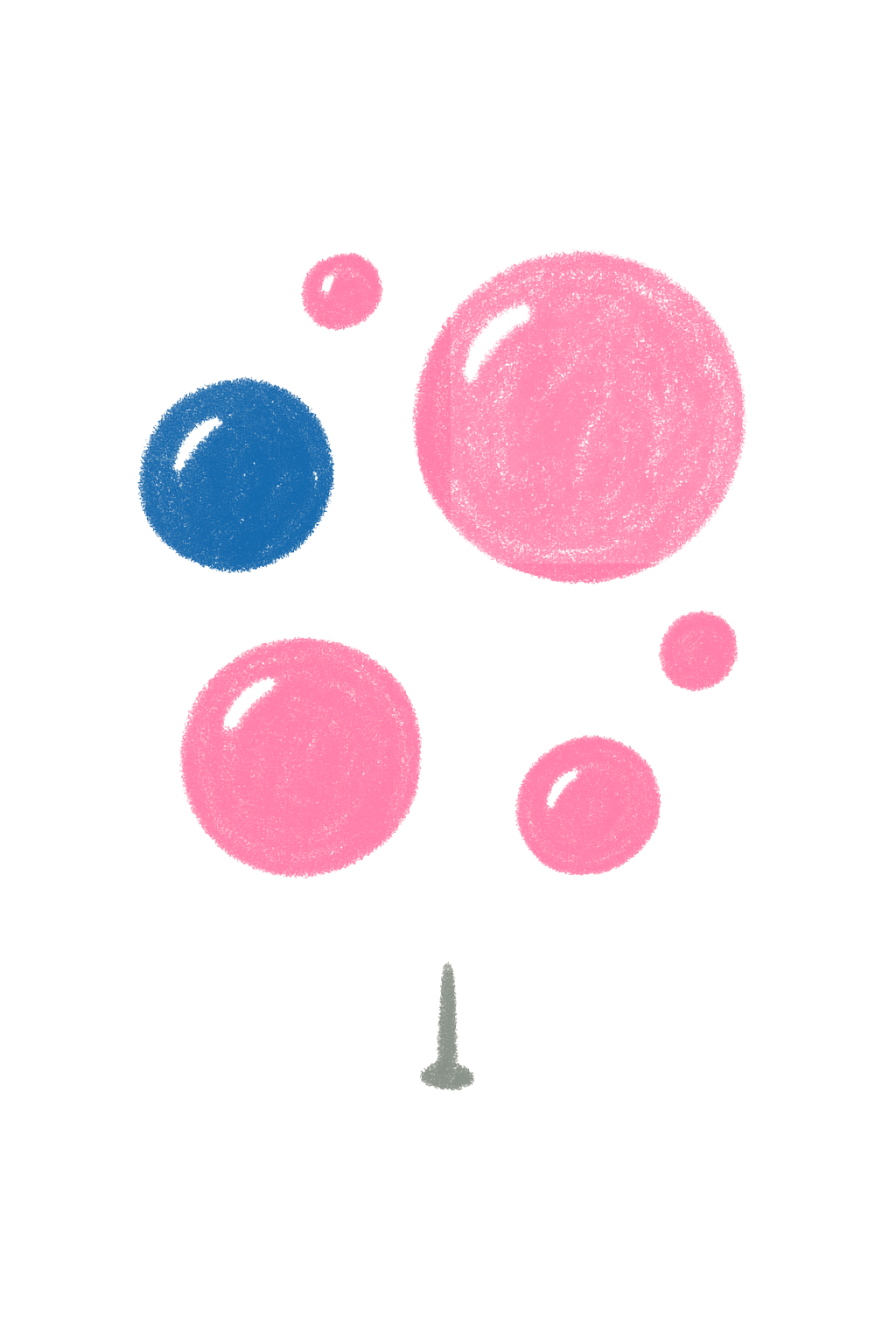

"A pin lies in wait for every bubble. And when the two eventually meet, a new wave of investors learns some very old lessons." - Warren Buffett

You can easily picture it. A beautiful, shimmering bubble, impossibly large and reflecting the hopes of millions, rising higher and higher, inflated by the belief in its permanence. Somewhere below, an unglamorous pin - reality - waits.

Right now, artificial intelligence is creating that kind of euphoria. The technology is genuinely transformative. The valuations, however, have detached from any reasonable assessment of near-term fundamentals. We're watching capital concentrate in a handful of names at multiples that historically precede painful corrections.

The question isn't whether AI will change the world. It will. The question is whether today's prices already reflect a decade of flawless execution - and what happens when reality falls short of perfection.

The Sound Premise Problem

Benjamin Graham apparently warned his student Warren Buffett: "You can get in a whole lot more trouble investing with a sound premise than with a false premise."

Today's sound premise is clear: artificial intelligence will reshape productivity, commerce, and human capability. It's not hype. It's happening.

But premise and price are different things. When you buy a stock, you're buying future cash flows, not a story. The relevant question isn't "Will this company benefit from AI?" but rather "At this price, what return can I reasonably expect over the next decade?"

A huge portion of today's market capital is committed based not on what companies will produce, but on what the next buyer will pay - the very definition of speculation. The disconnect between narrative and valuation creates fragility.

The Valuation Picture

The S&P 500 currently trades at a trailing P/E of approximately 30x. For context:

The long-term average since 1926 sits around 15-17x

Even the modern era of low rates established a "new normal" closer to 25x

The market is expensive. Not just expensive - historically expensive.

Within that expensive market, the AI-enabled tech sector trades at a significant premium. The median forward P/E for these businesses exceeds 45x - a 15-point premium over an already elevated index.

Consider Tesla. Despite being fundamentally an automotive manufacturer facing intense competition and flattening volumes, it trades at roughly 240x trailing earnings. Investors aren't paying for car profits. They're paying $240 for every $1 of current earnings in anticipation of robotaxis, humanoid robots, and AI dominance - despite the company missing earnings estimates in eight of the last ten quarters.

When narrative becomes the primary asset and fundamentals become secondary, risk escalates.

For unprofitable AI hopefuls, valuations rest entirely on price-to-sales multiples around 15x - levels not sustained outside the terminal phase of the 2000 dot-com bubble.

What's Different This Time (And What Isn't)

Fair question: isn't AI different from previous bubbles?

In some ways, yes. The leading AI beneficiaries - the hyperscalers and chipmakers - are genuinely profitable businesses with fortress balance sheets. This isn't 1999, when profitless companies with no business model commanded billion-dollar valuations. The core technology works, the adoption is real, and the revenue is growing.

But the pattern is familiar. A transformative technology emerges. Early investors make exceptional returns. The narrative spreads. Valuations detach from fundamentals. Late-stage capital piles in, driven by fear of missing out. Eventually, growth disappoints relative to the perfection already priced in.

The crashes aren't typically about the technology failing. They're about expectations resetting. The internet didn't fail in 2000 - it succeeded beyond imagination. But the NASDAQ still lost 78% peak-to-trough, and it took 15 years to recover.

Recognising the Pattern

You don't need to predict the catalyst. You need to recognise the setup.

The pin could be an earnings disappointment from a market darling. It could be capital expenditure on data centres failing to generate expected returns. It could be a leverage-induced liquidity event as margin calls cascade through an over-extended system.

Throw enough darts at this market and you're bound to hit something - NVDA, TSLA, perhaps the next generation of AI hopefuls. In 1999, it was CMGI, ICGE, WCOM. The names change. The pattern doesn't.

History suggests that when speculation looks easiest, it's at its most dangerous. Right now, chasing AI momentum feels effortless.

A Risk Management Framework

Could this rally extend for another year or two? Absolutely. Markets can remain expensive longer than any individual can remain solvent betting against them. Timing is impossible.

But risk management isn't about timing tops. It's about recognising when the risk-reward has shifted unfavourably and positioning accordingly.

Rotation toward quality and value. Shift capital from narrative-driven growth toward businesses with sustainable free cash flow, reasonable valuations, and genuine margins of safety. Defensive sectors and quality industrials with non-cyclical earnings become more attractive.

Strategic hedging. When volatility is compressed and complacency is elevated, asymmetric hedges become cheap. Targeted short positions or volatility products can provide meaningful protection without requiring perfect timing.

Maintain liquidity. Cash feels uncomfortable in a rising market. But liquidity provides optionality. When indiscriminate selling eventually occurs - and correlations rise as they always do in stress - dry powder allows you to acquire quality assets at distressed valuations.

The current environment demonstrates classic late-cycle behaviour: greed replacing discipline, narrative replacing analysis, momentum replacing valuation.

The Challenge Ahead

The lesson from history isn't to avoid transformative technology. It's to respect valuation. Progress takes time, and the biggest winners are rarely the most-hyped names at the peak.

The pin is out there. When it meets the bubble - and eventually it will - a new generation will learn what previous generations learned in 1929, 2000, and 2008: that gravity applies to markets just as it applies to everything else.

The challenge isn't predicting when this ends. The challenge is positioning to survive it when it does.

Matt Mobbs has over 25 years of experience in financial markets and equity trading. These views are his own and do not constitute financial advice or represent the views of any organisation.